Winning the Stock Market Game: Strategies for Strategic Predators

Oct 7, 2025

“The early bird gets the worm; the late bird gets the bullet.” – Sol Palha

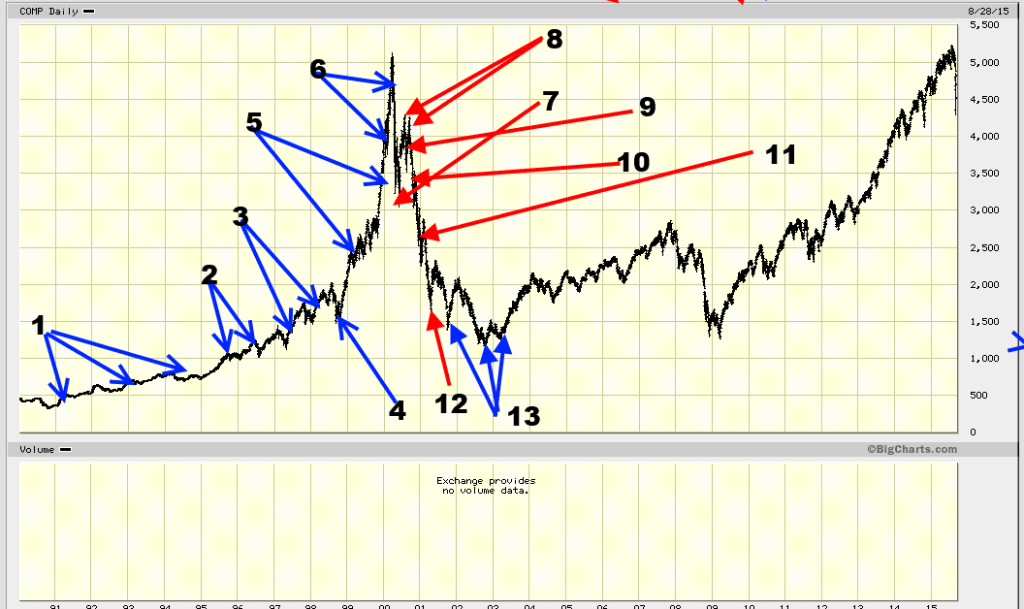

The market is not a classroom. It’s a psychological battlefield where timing, discipline, and clarity separate the hunters from the herded. Years ago, CMGI—a poster child of the dot-com mania—showed us the anatomy of collective delusion. This time, the NASDAQ takes centre stage, charting the 13 phases of mass mindset: a behavioural cycle as predictable as gravity and twice as unforgiving.

From GOOGL to NVDA, MSFT to BYDDY, the ticker doesn’t matter. The human operating system underlying every price chart hasn’t evolved since the tulip bulb craze. Fear expands, greed inflates, hope distorts, and then the market resets the board. The game is psychological before it is financial. And most investors? They’re not players. They’re the chips.

Most Investors Are Cannon Fodder—Here’s Why

The brutal math hasn’t changed: 90% lose, 10% win. That’s not hyperbole; it’s structural reality. The majority enter the market armed with CNBC soundbites, surface-level books, and misplaced confidence. They think they’re joining a chess match. They’re actually stepping into a casino designed by predators.

The scoreboard is written in blood: retail money enters late, exits wrong, and funds institutional profits. The 10% who win don’t “beat” the market by luck. They understand the psychological architecture of the crowd, position early, and exit while the herd is still euphoric. They’re not better stock pickers. They’re sharper behavioural analysts.

Rule #1: Ditch the Herd Mentality

Every failed investor shares a single fatal flaw: they follow the crowd. They buy when headlines scream “unstoppable,” and they sell when fear is thickest. They become exit liquidity for smarter players who anticipated the stampede months before.

The herd doesn’t analyse—it reacts. They chase narratives, echo influencers, and confuse motion with insight. Market tops are built on their FOMO; bottoms are carved out of their capitulation.

The ones who win do the opposite: they observe sentiment as a signal, not an instruction. When retail sentiment hits euphoric extremes, they trim. When panic spikes to despair, they accumulate. Herd behavior is the cleanest leading indicator in finance—if you have the stomach to invert it.

Rule #2: Kill Emotion or Get Killed

Emotion is the most valuable commodity in the market. Fear makes you sell into bottoms. Greed makes you chase tops. Hope glues you to sinking positions long after the thesis is dead.

The elite don’t eliminate emotion because they’re robots. They domesticate it. They build systems—position sizing, stop-losses, pre-set rules—that force clarity when adrenaline surges.

Look at the 2008 financial crisis. While the herd fled in terror, disciplined investors saw blood in the streets as a generational entry point. Those who bought AAPL, AMZN, or MSFT in the wreckage turned five-figure stakes into seven-figure fortunes over the next decade.

Fast-forward to the March 2020 COVID crash. Tesla at $70. Nvidia at $50. The weak panicked; the prepared stepped in with precision. They didn’t predict the bottom. They recognised emotional extremes for what they were: opportunity wearing a mask of disaster.

You either control emotion, or the market will do it for you—with surgical cruelty.

Rule #3: The Market Is a Rigged Casino—So Play Like the House

Retailers play like gamblers, chasing price spikes and betting on upside-down lottery tickets. Professionals play like the house, structuring trades to monetise herd behaviour.

Selling cash-secured puts on high-quality stocks during fear peaks is not flashy—but it’s lethal. You get paid to wait, collecting a premium while positioning to buy at levels retail has emotionally abandoned.

- 2008: Panic selling handed disciplined buyers once-in-a-decade entry points. Those who sold puts on quality names or accumulated at fire-sale valuations dominated the next bull run.

- 2020: While media screamed apocalypse, professionals sold volatility, sold fear, and quietly acquired blue chips while retail liquidated at generational lows.

The house doesn’t panic. It writes the rules others emotionally obey.

The Cycle of Pain: How the Herd Loses the Same Way Every Time

The crowd never learns. Their emotions follow a predictable arc—scepticism, denial, envy, panic, capitulation, and finally, amnesia. Every rally, every crash, every “new paradigm” gets filtered through this ancient psychological script. What changes are the tickers and the excuses? The sequence below isn’t theory—it’s the mass behavioural vector map every bull and bear market rides.

“Misery loves company, but stupidity demands it.” – Sol Palha

- This stock is going nowhere; fundamentals are weak.

- It’s pure luck; the fools who jumped in will regret it.

- Earnings are terrible; the breakout is fake.

- Holy smokes, it’s still going up… but it shouldn’t.

- Good thing I didn’t buy—I was right.

- Wait… what’s going on? Maybe I missed something.

- I’ll wait until the market improves; that’s the smart play.

- Why is it dropping now? It’s just a pullback—I won’t fall for it.

- I knew it would turn around—I should have loaded up.

- It’s dropping again… this is the buying moment.

- Bad news hits, the market plunges.

- Fear grips. Capitulation sets in. “The market is dead. I’m out.”

- Bottoming phase begins quietly… while they’re on the sidelines.

The cycle of pain isn’t about price—it’s about reaction time. The crowd moves emotionally, not strategically. They exit when volatility peaks, re-enter when sentiment is euphoric, and spend the rest of the cycle justifying why they were “almost right.”

Insider Tip 4: Emotions Are the Market’s Favourite Prey

The market doesn’t reward emotion—it punishes it with precision. Fear and greed don’t just cause mistakes; they dictate when those mistakes happen. Tops form when optimism overwhelms analysis. Bottoms form when despair suffocates rationality.

The herd is always late because its timing mechanism is emotional, not analytical. They buy into strength they emotionally trust (euphoria), and they sell into weakness they emotionally can’t bear (panic).

Your edge is to reverse that rhythm:

- When the crowd panics, you breathe.

- When they cheer, you quietly prepare exits.

- When they freeze, you move.

Detach. Stay surgical. Ignore the noise. Master sentiment shifts like a chess grandmaster reads the board.

“The world can be your oyster, or you can be an oyster in the world.” – Sol Palha

Integrating Smart Investment Techniques with Fundamentals

The patient crushed the impulse. Dollar-cost averaging (DCA) and fundamental analysis are the spine of disciplined wealth building.

DCA removes emotion from timing. Buy consistently—up or down. When the market falls, you acquire more at a discount. When it rises, you buy less at higher prices. Over time, your cost basis smooths out, outperforming the manic timers who always seem to be “waiting for the perfect entry.”

Fundamental analysis anchors your decisions in reality. Durable growth, fortress balance sheets, and capable management beat hype every cycle. Benjamin Graham’s intrinsic value discipline proved effective in the 1930s and again in 2008, because numbers don’t follow narratives—they reveal them.

During the 2008 crash, disciplined investors who adhered to DCA and purchased fundamentally sound companies reaped substantial gains in the following decade. Buffett calls patience a strategy because it is one.

DCA isn’t passive—it’s psychological armour. It forces rationality when the herd is in chaos.

Technical Analysis + Mass Psychology: The Winning Combo

Numbers show you structure. Psychology shows you timing. Combine both, and you wield a contrarian edge sharper than any macro forecast.

Fear Spikes = Opportunity.

- VIX readings above 40 historically mark capitulation zones.

- March 2020: VIX hit 85.47 (near 2008’s 89.53). Nasdaq surged 7.3% on April 6.

Sentiment Extremes = Reversals

- Bullish sentiment below 15% or bearish sentiment above 55% → historical bottoming conditions.

Oscillators Confirm

- RSI <30 or Stochastic <20 = oversold, fear-driven capitulation.

- October 2022: Market deeply oversold, but sentiment wasn’t extreme → bounce, not reversal.

The Pattern: Sentiment fractures first, price follows. Oscillators expose fear. VIX confirms panic. Those who track all three act before the herd regains its senses.

The Ultimate Contrarian Playbook: Triple-Threat Warfare

When markets collapse, elites don’t join the stampede—they weaponise it.

- The Put-Selling Machine – Profit from panic.

- 2020: MSFT put premiums soared 300–400%.

- Target blue-chip stocks down 40%+.

- Sell puts 15–35% below market.

- Position to own only fortress-balance-sheet names.

- The Call Option Accelerator – Exploit recovery.

- VIX above 35 = time to load LEAPS.

- Buy 18–24 month calls on sector leaders.

- Target 15–20% above market strikes.

- Fund using put premium income.

- The Direct Purchase Protocol – Build Core Positions with Discipline.

- Buy at –30%. Double at –40%. Triple at –50%.

- Reserve 25% of the total in cash for extreme contingencies.

- Only companies with dominance, low debt, strong cash flow, and insider conviction.

Execution: Set auto-buys. Ignore the screaming headlines. Track insider buying. Increase aggression as fear peaks.

Final Strike: Wealth Is Built in Silence, Not in Euphoria

When CNBC runs “Markets in Crisis” specials, that’s your bell. Druckenmiller said it best: “The best investors don’t diversify. They bet big when the odds are stacked in their favour.”

The market’s chaos is not a threat—it’s an opportunity factory for those with discipline, capital, and a cool head. Put-selling funds your calls. Calls ride the rebound. Core buys build empires.

The crowd chases what it thinks it knows. The elite question everything. Confucius nailed it centuries ago: “Real knowledge is to know the extent of one’s ignorance.”

The question isn’t whether the cycle will repeat. It’s whether you’ll still be part of the herd when it does.